Not sure how to get started or need some help updating your estate plans? Request a free Estate Planning Guide and Will Starter Kit by emailing

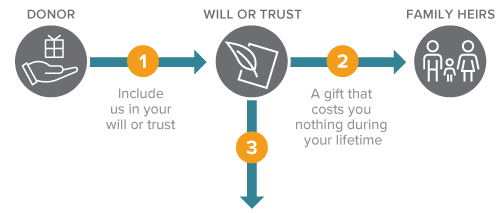

Gifts from Your Will or Trust

How It Works

- Include a gift to TEAM in your will or trust. (Here is sample bequest language for your will.)

- Make your bequest unrestricted or direct it to a specific purpose.

- Indicate that you would like a percentage of the balance remaining in your estate or trust, or indicate a specific amount.

- Tell us about your gift so we may celebrate your generosity now.

Important Related Topics

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law, there is no upper limit on the estate tax deduction for your charitable bequests.

Please click here to let us know if you have already included TEAM in your estate plan or if you are considering doing so. Thank you.

- More detail about gifts from your will or trust.

- Frequently asked questions.

- Contact us so we can assist you through every step.

The gift planning information presented on this site is intended as general. It is not to be considered tax, legal, or financial advice. Please consult your own personal advisors prior to any decision.

Read full disclaimer|Site Map|Planned Giving Marketing Content © 2022 by MajorGifts.com.

TEAM's mission:

To partner with the global Church in sending disciples who make disciples and establish missional churches to the glory of God.

© TEAM 2023 | All Rights Reserved

Powered by

Solertiae Sites